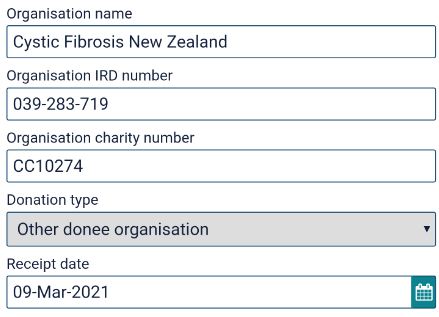

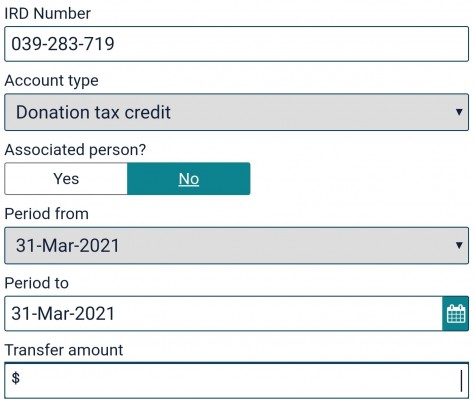

You can donate your tax credit to help provide a greater level of support for New Zealanders with CF by using your annual tax receipt to claim back a third of your donations from the tax department.

By donating your tax rebate to Cystic Fibrosis NZ you are helping people with CF to live a life unlimited.